Class 8 Auction Pricing Approaches Year-Over-Year Parity

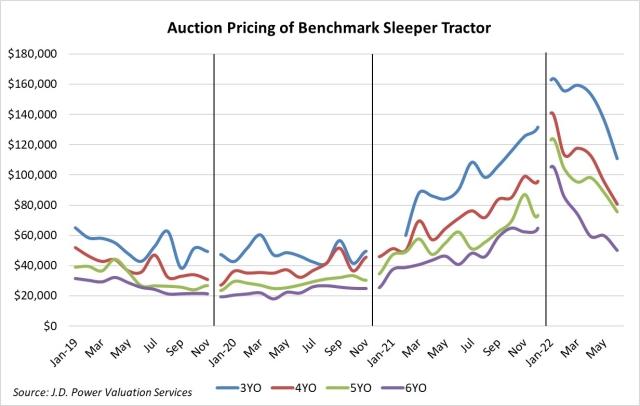

Auction volume increased this month, and pricing continued to steeply decline. It appears that volume is driven mainly by small fleet liquidations, large fleets offloading their oldest units, and individuals either exiting the industry or going to work for a fleet. Pricing declined throughout the month, which means the averages below include higher pricing from earlier in the month. Actual current pricing is lower than these figures reflect, and in fact should be close to year-over-year parity by the time you read this.

Looking at two- to six-year-old trucks, June’s average pricing for our benchmark was as follows:

- Model year 2021: $153,889; no basis for comparison in May

- Model year 2020: $111,001; $25,731 (18.8%) lower than May

- Model year 2019: $80,727; $14,926 (15.6%) lower than May

- Model year 2018: $75,641; $12,811 (14.5%) lower than May

- Model year 2017: $50,107; $9,747 (16.3%) lower than May

In June, three- to five-year-old trucks averaged 16.7% less money than May, but 19.4% more money than June 2021. Year over year, late-model trucks sold in the first six months of 2022 averaged 80.7% more money than the same period of 2021. Year-to-date, four- to six-year-old sleepers have depreciated 6.9% per month on average.

Through June, late-model pricing was still 68.9% higher than the previous pre-pandemic peak in the 3rd quarter of 2018, so values are still extremely high in historical terms. Also, the newest, lowest-mileage trucks available have barely depreciated at all. Overall, we are still in the early stages of the correction, and pricing should continue to drop closer to historical norms. Freight economics still support a relatively healthy used truck market once we work through the excess capacity of the pandemic spot rate bubble.