Volume-Driven Depreciation Reappears in the Class 8 Market

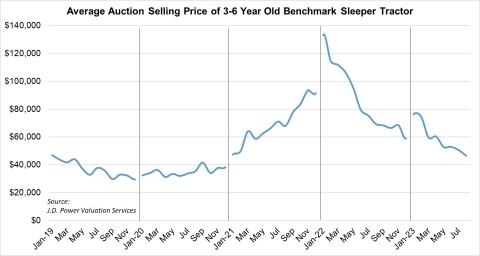

Following a two-month respite from depreciation, downward pressure on pricing materialized once again in August.

Looking at three- to seven-year-old trucks, average pricing for our benchmark truck in August was:

- Model year 2021: $63,375; $599 (0.9%) lower than July

- Model year 2020: $59,543; $7,382 (11.0%) lower than July

- Model year 2019: $33,469; $8,599 (20.4%) lower than July

- Model year 2018: $29,432; $355 (1.2%) higher than July

- Model year 2017: $22,136; $594 (2.8%) higher than July

It is becoming increasingly difficult to separate the wheat from the chaff in the auction channel. The number of trucks with missing titles, unverified mileage, and other issues is increasing. We do not include those trucks in our averages.

The late-model segment moved back downward in August, with four- to six-year-old trucks bringing 11.3% less money than in July, and 33.3% less money than August 2022. In the first eight months of 2023, late-model sleepers brought 42.5% less money than the same period of 2022. Monthly depreciation in 2023 is averaging 4.8%. The newest model years available in the marketplace are bringing about 6% more money than the strong pre-pandemic period of 2018 in nominal figures, or 15% less if adjusted for inflation.

Volume is increasing across-the-board, and the number of four- and five-year-old off-lease trucks continues to grow. Those trucks are primarily equipped with 13L engines and have extremely high mileage. Our averages do adjust for mileage, but not for spec. Trucks with more desirable specs and mileage are selling for amounts higher than our averages.