Used Market Update: July 23, 2020

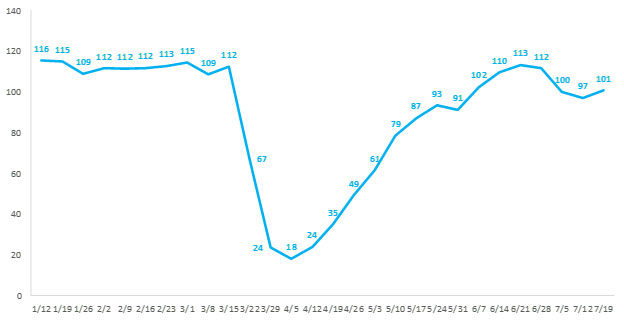

Wholesale auction sales move back above 100,000 units following brief slowdown. After dropping to 97,000 units the week ending July 12, wholesale auction sales of vehicles up to 8 years old increased 4% reaching an estimated 101,000 units the week ending July 19. Despite the healthy week-over-week increase, weekly sales totals were 5% below JD Power’s pre-virus forecast of 106,000 units for the period.

Weekly Wholesale Auction Sales (thousands)

Segment-level auction sales on the mainstream side of the market increased by an average of 8%. Large SUV and car, along with midsize pickup sales grew 11% to 15%, respectively, while at the opposite end of the spectrum, compact car and midsize SUV sales were flat. Premium segment results were positive. As a collective, premium segment sales increased by an average 6% week-over-week. Large premium SUV and car sales increased by an average 20%, while other premium segments increased 1% to 5%.

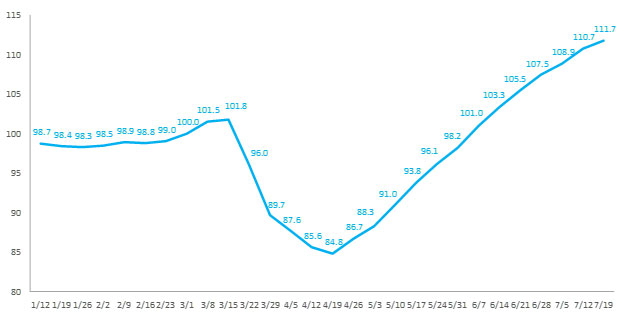

Wholesale Auction Price Growth Continues but Momentum Slowing

Wholesale auction prices improved for the 13th consecutive week, rising 1 percentage point for the week ending July 19. Last week’s result was the smallest week-over-week increase recorded since prices began their recovery in April. However, prices have grown 32% over the past 13 weeks and are now 12% higher than at the beginning of March.

Weekly Wholesale Auction Price Index (Mar 1 = 100)

Wholesale prices for mainstream segments for the week ending July 19 increased by an average of 1% vs. the prior week. Large pickup prices continue to be exceptionally strong, increasing 1.7%. Most mainstream segment prices grew 1% to 1.3%, however, small SUV, compact SUV, midsize car and large car gains were lower, ranging from 0.3% to 0.7%. Premium vehicle prices were up by an average of 1.2%, with growth being led by a 1.8% increase in the small premium SUV segment. Small, compact and midsize premium car segments were also strong with prices up 1.5% each. However, at the opposite end of the spectrum, large premium car prices were essentially flat, increasing by a slight 0.1%. While wholesale prices remain strong, the rate of growth week-over-week is beginning to slow.

Expectations remain that prices will begin to drift lower heading into August as pent-up demand wanes and pandemic-related macro-economic headwinds increase. By year's end, prices are expected to be on par with pre-virus levels. It is important to note, however, that while the outlook is relatively optimistic, there remains a great deal of uncertainty surrounding the effect of new outbreaks, the potential for another round of federal stimulus and overall employment conditions. Given these unknowns, a heightened degree of market volatility should be expected.

Used Vehicle Retail Sales Performance Slowed as Prices Continued to Rise

Sales of used vehicles at franchised dealers beat pre-virus forecast by 1% for the week ending July 19. While this represents a slowdown vs. the past six weeks, it is still indicative of strong demand for used vehicles, which is consistent with prior periods of challenging economic conditions. Used retail prices rose once again, increasing 0.5 percentage points week over week during the week ending July 19. Prices are now 4% higher than pre-virus levels.