Used Market Update: June 17, 2020

JD Power Valuation Services Used Market Update: June 17, 2020: Wholesale Auction Sales Exceed 105,000 Units

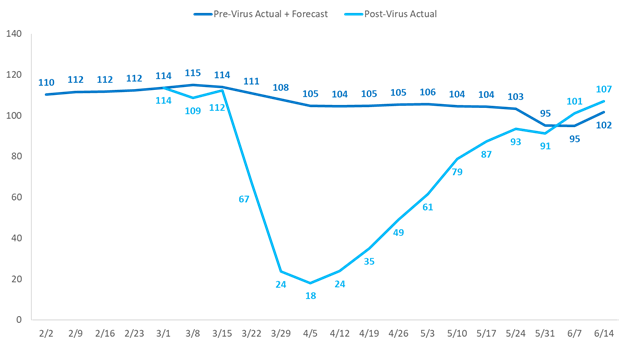

Wholesale auction sales of vehicles up to 8 years old continued to climb last week. Sales reached an estimated 107,000 units the week ending June 14, up 6% vs. the week prior and 5% more than the 102,000-unit pre-virus forecast for the week. Sales over the past two weeks have exceeded 100,000 units per week, the first time this has occurred in three months.

Weekly Wholesale Auction Sales

Segment-level auction sales were up across the board last week. Mainstream growth was led by the small car segment’s 24% increase, followed by a 16% increase for small SUV. Large SUV and compact car sales grew 19% and 12%, respectively, vs. the week before. Growth for remaining segments was in the single digits. Small SUV is the only mainstream segment with sales currently above pre-virus levels.

As a collective, premium segment auction sales rose 7% week over week. Compact premium SUV sales last week were 40% higher than pre-virus levels the largest increase in the industry, with the midsize premium SUV segment showing a 16% increase.

Wholesale Auction Prices Continue to Escalate

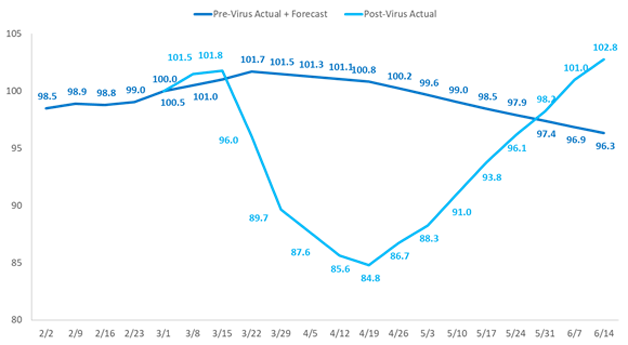

Wholesale auction prices of vehicles up to 8 years old improved for the eighth consecutive week, rising 1.8 percentage points for the week ending June 14. Prices improved 18 percentage points over the past eight weeks and are now 3% higher than they were at the beginning of March.

Weekly Wholesale Auction Price Index

While wholesale prices for most segments increased by almost 2% vs. the week before, prices of midsize pickups jumped nearly 4%. Small car (+3.2%), compact car (+2.6%) and large pickup (+2.2%) segment growth also outpaced the mainstream segment average.

Premium segment prices rose 1.5% to 2.4%, excluding large premium car where prices were up just 0.6% vs. the prior week. Sales for the segment jumped 30% during the week, representing an industry high.

As we have said repeatedly, prices are expected to remain relatively strong before falling modestly in July as dealer inventory needs are met and larger quantities of off-lease and off-rental vehicles enter the market. However, the strength observed in used wholesale prices to date could indicate more upside potential than higher supply and macro-economic pressures (such as high unemployment) would dictate under less volatile conditions.

Used Vehicle Retail Sales Surpass Pre-Virus Forecast on Stable Pricing

Sales of used vehicles at franchised dealers beat the pre-virus forecast by 11% for the week ending June 14. The strong demand for used vehicles is consistent with prior periods of challenging economic conditions. Further, reduced incentives on new vehicles drove up monthly payments, which further bolstered demand for the affordability of used vehicles. Despite the strong volume gains at retail, used retail prices were essentially unchanged for the week ending June 14 vs. the prior week and are down just 1% from pre-virus levels.