Class 8 Auction Environment Downshifted in May

Volume increased moderately in May, in line with expectations. Selling prices relaxed overall, although low-mileage trucks continue to bring strong money.

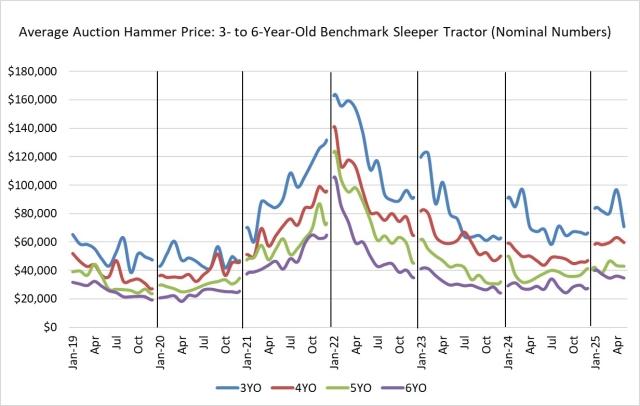

Looking at late-model sleeper tractors, average pricing for our benchmark truck in May was:

Model year 2023: $70,792; $25,943 (26.8%) lower than April

Model year 2022: $59,644; $3,508 (5.6%) lower than April

Model year 2021: $42,999; $471 (1.1%) lower than April

Model year 2020: $34,576; $1,341 (3.7%) lower than April

Model year 2019: $25,400; $3,239 (11.3%) lower than April

At auctions in May, selling prices for the four- to-six-year-old cohort of our benchmark truck averaged 3.7% lower than April, and 23.9% higher than May 2024. Pricing for that group is currently 20.3% higher than the strong pre-pandemic period of 2018 in nominal figures (5.7% lower if adjusted for inflation), and 84.0% higher than the last market nadir in late 2019 (47.4% higher when adjusted for inflation).

Historically, by midyear we typically see a meaningful number of three year-old trucks moving through auctions. That has not been the case in 2025. Some end users seem to be keeping their rigs in service longer than usual, possibly hedging their bets and taking advantage of freight available now while postponing the decision to trade for new. This low volume of model-year 2023 trucks means our averages have been skewed each month based on mileage mix of trucks sold. As such, monthly comparisons for that year are not indicative of actual market movement. The main takeaway is trucks with under 400,000 miles continue to bring strong money.