May 2025 Commercial Truck Guidelines

SUMMARY

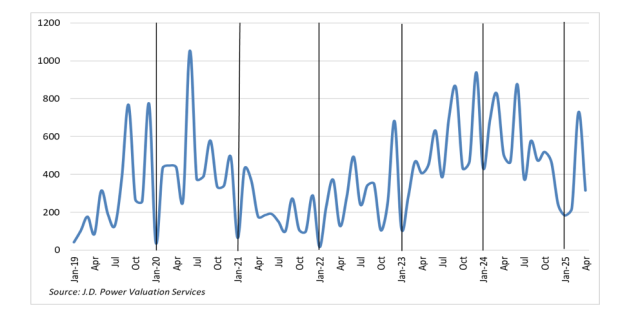

Class 8 auction volume in April 2025 decreased substantially from March, but pricing ticked upward. Due to time constraints, retail data will not be available this month. We will provide that data again in the next edition.

CLASS 8 AUCTION UPDATE

Following a very strong start to “selling season” in March, volume decreased more than expected in April. Pricing continued to trend upward.

Looking at late-model sleeper tractors, average pricing for our benchmark truck in April was:

- Model year 2023: $96,735; $16,472 (20.5%) higher than March

- Model year 2022: $63,152; $3,542 (5.9%) higher than March

- Model year 2021: $43,470; $3,118 (6.7%) lower than March

- Model year 2020: $35,917; $1,428 (4.1%) higher than March

- Model year 2019: $28,639; $141 (0.5%) higher than March

At auctions in April, selling prices for the four- to-six-year-old cohort of our benchmark truck averaged 1.3% more than March, and 30.3% higher than April 2024. Pricing for that group is currently 19.4% higher than the strong pre-pandemic period of 2018 in nominal figures (6.0% lower if adjusted for inflation), and 91.1% higher than the last market nadir in late 2019 (53.6% higher when adjusted for inflation).

Trucks with under 300,000 miles brought extremely strong money in April, suggesting end users are competing for lightly-used trucks. This development explains the very wide swing in value for model-year 2023 trucks in the table above, and points to healthier bidding activity in a tightening supply environment. That observation, combined with the temporary rollback of tariffs on Chinese products, makes us more bullish on used truck conditions in the short term. Higher demand combined with lower supply is Economics 101.

Volume of the Three Most Common Sleeper Tractors (3- to 7-Year-Old) Sold Through the Two Largest Nationwide No-Reserve Auctions