Class 8 Auction Market Outperforms Forecast for Another Month

September’s auction results were a bit of an upside surprise, with late-model trucks losing minimal value month-over-month. Volume was similar to August.

Looking at two- to six-year-old trucks, September’s average pricing for our benchmark truck was:

- Model year 2021: $147,458 (no basis of comparison for August)

- Model year 2020: $89,336; $4,090 (4.4%) lower than August

- Model year 2019: $80,002; $4,767 (6.3%) higher than August

- Model year 2018: $59,104; $5,302 (8.2%) lower than August

- Model year 2017: $44,659; $652 (1.5%) higher than August

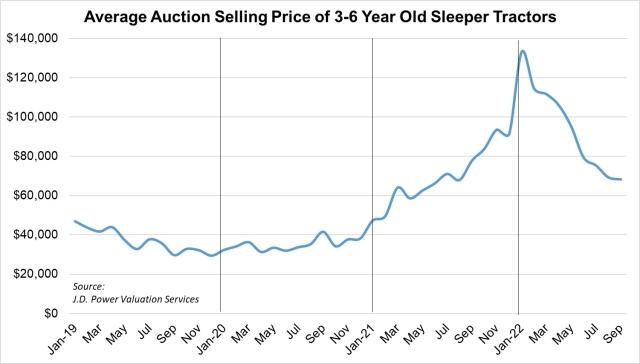

In September, three- to six-year-old trucks averaged 1.4% less money than August, and 12.2% less money than September 2021. Year over year, late-model trucks sold in the first nine months of 2022 averaged 50.9% more money than the same period of 2021. Year to date, three- to six-year-old sleepers have depreciated 5.8% per month on average.

Year-over-year comparisons have finally turned negative, but depreciation is relaxing. Late-model sleepers are bringing 45% more money than the last pre-pandemic peak. We had expected pricing to fall another 20% before leveling out, and it looks like that forecast was pessimistic. Seasonality may be playing a role right now, but the tight availability and high price of new trucks is keeping demand for sub-450,000-mile trucks extremely strong. Of course, this also means the price difference between low- and average-mileage trucks continues to increase.

Stay tuned for the complete analysis of September's Class 8 retail and medium duty results in the upcoming edition of Guidelines.