Class 8 Retail Market Correction Underway

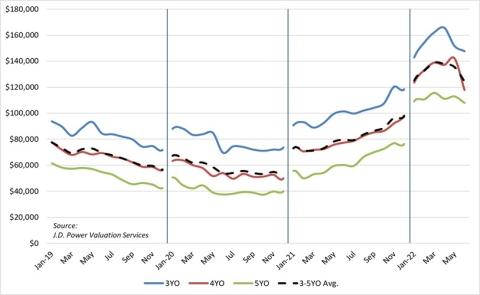

The average sleeper tractor retailed in June was 69 months old, had 464,365 miles and brought $108,641. This figure is an 8.9% drop from May’s record high and supports our assessment that the retail market correction is underway. Compared with May, this average sleeper was two months newer, had 20,446 (4.6%) more miles, and brought $10,589 (8.9%) less money. Compared with June 2021, this average sleeper was one month newer, had 13,466 (3.0%) more miles, and brought $41,882 (62.7%) more money.

Looking at two- to six-year-old trucks, June’s average pricing was as follows:

- Model year 2021: $182,303; $5,135 (2.7%) lower than May

- Model year 2020: $147,761; $4,016 (2.6%) lower than May

- Model year 2019: $117,843; $24,263 (17.1%) lower than May

- Model year 2018: $107,899; $5,003 (4.4%) lower than May

- Model year 2017: $88,963; $7,661 (8.6%) lower than May

The average for model-year 2019 in the above table is negatively affected by a relatively large group of identical trucks that sold for unimpressive money. Eliminating those trucks would still result in a 15% decrease month-over-month, so the figure is not far off from actual overall market movement.

Three- to five-year-old trucks brought an average of 8.2% less money in June than May. Trucks in this age group brought 77.9% more money in the first six months of 2022 than the same period of 2021. Due to June’s lower figures, average price movement per month in 2022 is now flat for the year. Overall, retail pricing is still roughly 50% higher than the last pre-pandemic peak in late-2018, but that difference will continue to close in upcoming months.