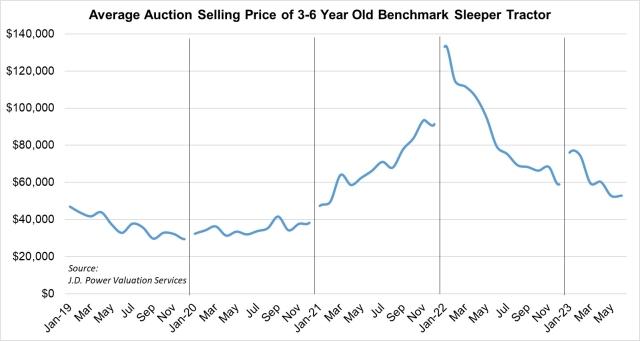

Upside Surprise for June Class 8 Auction Pricing

As is typical for June, Class 8 sales volume was substantial. Despite this increased volume, pricing was surprisingly stable, actually ticking up a bit from May.

Looking at three- to seven-year-old trucks, average pricing for our benchmark truck in June was:

- Model year 2021: $76,394; $3,406 (4.3%) lower than May

- Model year 2020: $61,025; $2,001 (3.4%) higher than May

- Model year 2019: $43,738; $1,246 (2.9%) higher than May

- Model year 2018: $30,242; $658 (2.2%) lower than May

- Model year 2017: $21,661; $183 (0.8%) lower than May

As we’ve mentioned, trucks put into service in the early days of the pandemic have led a tough life, since they were essentially required to do the work of more than one truck. As such, these trucks have entered the used market with extremely high mileage for their age. We adjust our averages for mileage, but that factor nonetheless depresses selling prices, particularly for the 2021 model year. Trucks with average mileage for their age have not depreciated as heavily.

Despite this situation, late-model trucks actually brought 3.0% more money in June than in May, but 34.6% less money than June 2022. In the first six months of 2023, late-model sleepers brought 45.4% less money than the same period of 2022. June’s stable pricing caused our year-to-date monthly depreciation average to relax to 5.6%. The newest model years available in the marketplace have settled in at just under 20% more money than the strong pre-pandemic period of 2018 in nominal figures, or roughly comparable money if adjusted for inflation.

We expected pricing to fall below the 2018 peak before leveling out, so June’s flat month-over-month result is an upside surprise. The influx of off-lease units continues, but it’s possible continued strength in contract rates combined with the recent bump in spot rates has been enough to curtail depreciation for the time being.