Late-Model Sleepers Still Bringing Strong Money

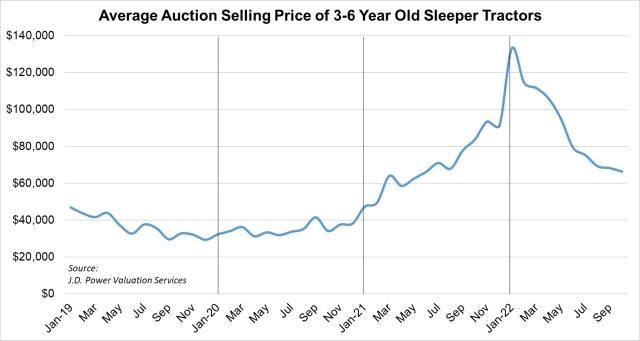

October’s Class 8 auction volume was substantially lower than the previous two months. Pricing continued to decline moderately.

Looking at two- to six-year-old trucks, October’s average pricing for our benchmark truck was:

- Model year 2021: (no trucks sold)

- Model year 2020: $89,025; $311 (0.3%) lower than September

- Model year 2019: $74,447; $5,555 (6.9%) lower than September

- Model year 2018: $63,349; $4,245 (7.2%) higher than Setpember

- Model year 2017: $38,584; $6,075 (13.6%) lower than September

In October, three- to six-year-old trucks averaged 2.8% less money than September, and 20.8% less money than October 2021. Year over year, late-model trucks sold in the first ten months of 2022 averaged 41.6% more money than the same period of 2021. Year to date, three- to six-year-old sleepers have depreciated 5.6% per month on average.

Year-over-year comparisons are in negative territory, but depreciation is still minimal for low-mileage trucks and moderate for average-mileage trucks. Late-model sleepers are still bringing 40-45% more money than the last pre-pandemic peak. Market dynamics should place increased downward pressure on used truck pricing in 2023, but for now, auction pricing is outperforming expectations.